Construction confidence is up in January, ABC says

- September 7, 2020

- Posted by: Alan Hageman

- Category: News

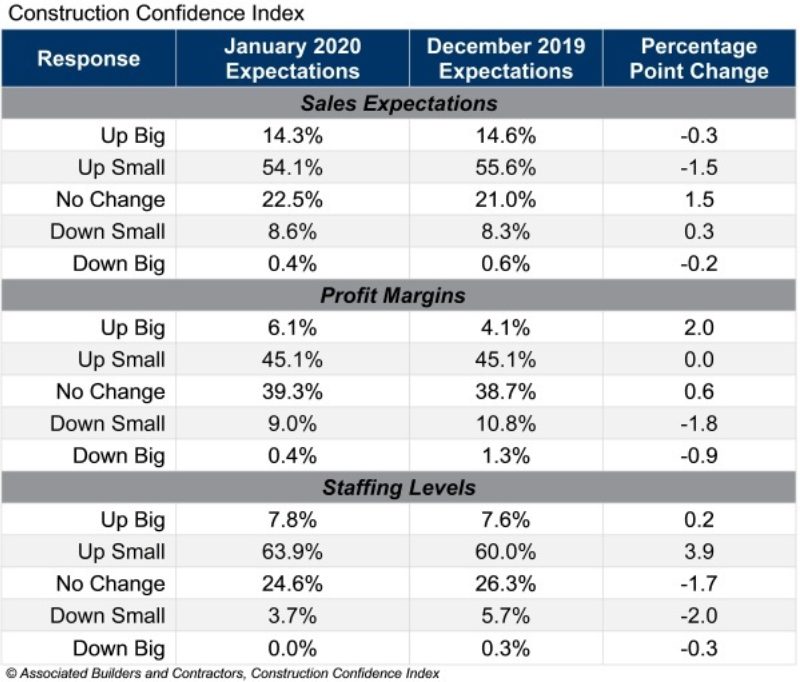

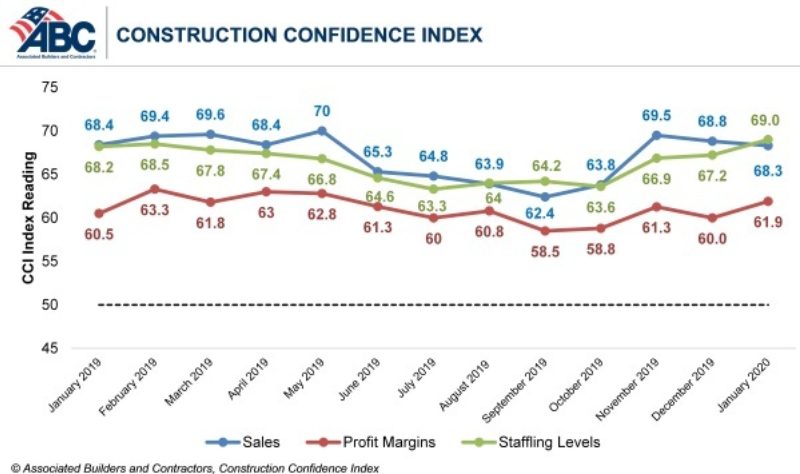

Confidence among U.S. construction industry leaders generally improved in January, consistent with the burgeoning momentum of the U.S. economy during the early weeks of 2020, according to the Associated Builders and Contractors (ABC) Construction Confidence Index. While the reading for sales expectations edged lower for the month, confidence pertaining to sales, profit margins and staffing levels remain well above the threshold of 50, signaling expected growth in those three metrics.

As of January 2020, nearly 72% of contractors expected to expand their staffing levels over the next six months, while more than 68% expect their sales levels to increase. Approximately 51% expect their profit margins to increase, a reflection of skills shortages that have driven costs higher and stunted profit margin growth among many contractors. That said, fewer than 10% of contractors expected profit margin declines over the next two quarters.

- The CCI for sales expectations decreased from 68.8 to 68.3 in January.

- The CCI for profit margin expectations increased from 60 to 61.9.

- The CCI for staffing levels increased from 67.2 to 69.

“It’s no secret that much has transpired since January,” said ABC chief economist Anirban Basu. “At this moment, business confidence in America is ratcheting lower as travel, hospitality, entertainment and other segments of the economy are rocked by COVID-19. Interruptions to the global supply chain, a crash in oil prices and other phenomena are also putting more pressure on significant parts of the economy, which is likely already in recession.

“The good news is that preexisting backlog, as indicated by ABC’s Construction Backlog Indicator, insulates many contractors from near-term dislocations,” said Basu. “Work on existing projects is ongoing, and that will help support many contractors in terms of keeping staff in place and generating cash flow. However, when Boston halted construction on major projects this week, that created a new dynamic, one in which backlog is no longer a source of protection during the early stages of a downturn for impacted construction firms.

“Beyond that, the weakness pervading the broader economy will aggressively seep into nonresidential construction, translating into fewer construction starts, particularly in private construction segments,” said Basu. “Public construction volume is also vulnerable since state and local government finances are already deteriorating due to a dearth of retail sales, hotel and other tax collections. But a federal stimulus package is in the works, and the hope is that this will generate a new set of opportunities for U.S. nonresidential construction firms.”