Engineering and Construction Cost Index Finishes the Year Strong

- June 20, 2021

- Posted by: Alan Hageman

- Category: News

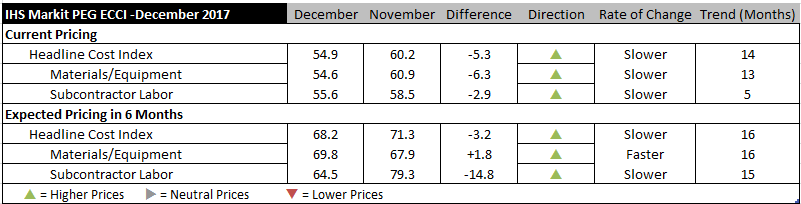

Construction costs rose again in December, according to IHS Markit (Nasdaq: INFO) and the Procurement Executives Group (PEG). The current headline IHS Markit PEG Engineering and Construction Cost Index registered 54.9, with both materials/equipment and labor sub-indexes coming in above 50.

The materials/equipment price index was 54.6 in December, moving down from the November figure of 60.9, the highest reading in the last five years. Unlike recent months, price increases were not widespread in December. Carbon steel pipe prices did not show any price changes compared to last month; turbines had lower prices. Ten out of 12 components in the current materials and equipment sub-index continued to show increasing prices. However, with the exception of ocean freight (both Asia to the U.S. and Europe to the U.S.), the diffusion index for every category in the materials and equipment index came in lower compared to last month, indicating a slower pace of price increases.

“Cost pressures increased across 2017 as a synchronized global expansion, some supply-side disruptions and a softening U.S. dollar tightened supply chains and boosted commodity prices,” said John Mothersole, research director – Pricing and Purchasing, IHS Markit. “For 2018, however, we see slower growth in China and higher interest rates keeping price escalation contained. The key test will come in labor markets, which are already near full employment in the U.S. Will tax cuts spark even better employment growth and trigger accelerating wage gains? If so, cost escalation will continue to be strong.”

Current subcontractor labor prices continued to rise in December, registering 55.6, though were down slightly from the fast pace of 58.5 in November. Regionally, the United States West, South and Northeast had higher labor costs. In the U.S. Midwest, labor costs did not change from last month. In Canada, the results were mixed once again; labor costs were flat in Western Canada and rose in Eastern Canada.

The six-month headline expectations index recorded another month of increasing prices. The index figure moved down from 71.3 in November to 68.2 this month. The materials/equipment index stayed positive at 69.8, a slight uptick from November’s 67.9. Expectations for future price increases were widespread, with index figures for every component coming in strongly above neutral. Price expectations for sub-contractor labor came in at 64.5 in December. Labor costs are expected to rise in all regions of the United States and Canada.

In the survey comments, respondents indicated some optimism for 2018. In general, there were no shortages for materials.

To learn more about the IHS Markit PEG Engineering and Construction Cost Index or to obtain the latest published insight, please click here.