U.S. Economy Falls 4.8% in 1st Quarter of 2020 Due to COVID-19

- August 11, 2020

- Posted by: Alan Hageman

- Category: News

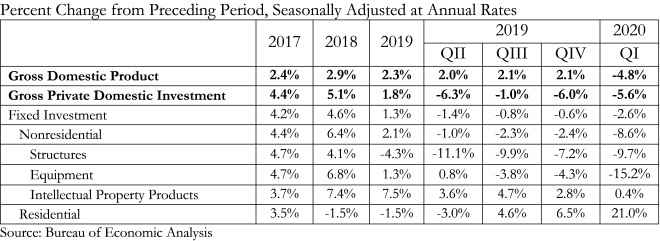

The U.S. economy contracted at an annualized 4.8% rate during the first quarter of 2020 as a result of the ongoing global pandemic, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Economic Analysis. The decline in GDP is largely a reflection of the final three weeks of March, which devastated the economy.

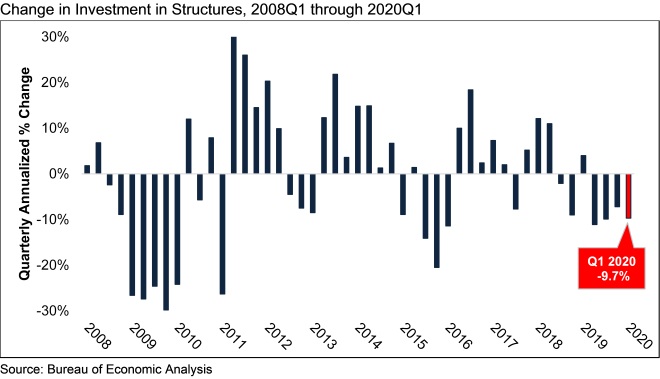

Declines in consumption expenditures, nonresidential fixed investment, exports and private inventory all contributed to the onset of recession during the year’s first quarter, while increases in residential fixed investment, federal government spending and state and local government spending helped offset some of the losses. Investment in nonresidential structures fell 9.7% on an annualized basis and has declined for four consecutive quarters.

“The question has been how much the pre-existing backlog—which stood at 8.2 months in February, according to ABC’s Construction Backlog Indicator—would shield the nonresidential construction sector from what has become a remarkably deep recession,” said ABC Chief Economist Anirban Basu. “Combined with the categorization of construction as an essential industry in many states, it was expected that construction activity would hold up well.”

“Today’s release indicates that backlog is not the sturdy shield against the initial phases of a recession that it was in the past,” said Basu. “In certain communities, including California, Pennsylvania and Boston, a significant fraction of construction activities have not been viewed as essential. Moreover, some owners of projects have become skittish, and therefore have been actively contemplating whether or not to postpone or cancel projects that otherwise would have begun. Even prior to the pandemic, there was some concern among private developers that certain segments had been overdeveloped, such as hotels, office space and apartments.”

“The second quarter will be considerably worse,” said Basu. “Still, backlog and an essential industry classification will render activity in nonresidential construction more stable than in many other industries. Many project owners may decide to rebid projects with the hope of garnering more favorable bids in what is perceived to be an emerging buyer’s market. However, if Congress passes an infrastructure-oriented stimulus package, project owners may find that the cost savings are not nearly as significant as anticipated due to rising materials costs and other factors.”