While nonresidential construction decreases, GDP expands in Q3

- November 12, 2020

- Posted by: Alan Hageman

- Category: News

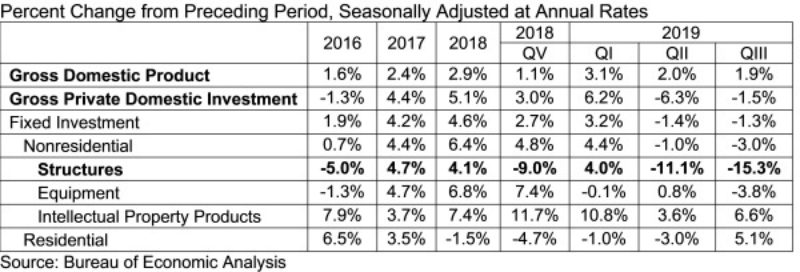

The U.S. economy expanded at an annualized rate of 1.9 percent in the third quarter of 2019 despite contracting levels of nonresidential investment, according to an Associated Builders and Contractors (ABC) analysis of data released by the U.S. Bureau of Economic Analysis. Nonresidential fixed investment declined at a 3 percent annual rate in the third quarter after declining at a 1 percent rate in the second quarter.

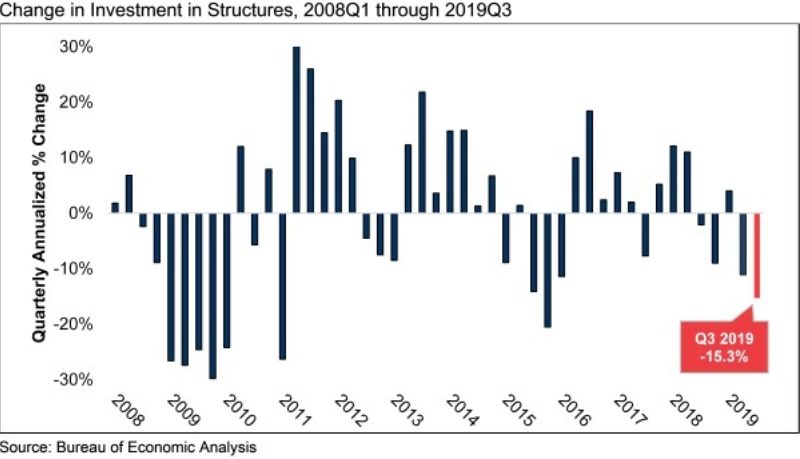

The annual rate for nonresidential fixed investment in structures, a component closely tied to construction, declined 15.3 percent in the third quarter. Investment in structures has now contracted in four of the previous five quarters, including an 11.1 percent decline in the second quarter of 2019.

“[The] report reinforced a number of observations regarding the U.S. economy and the nation’s nonresidential construction sector,” said ABC chief economist Anirban Basu. “First, the economy is slowing. While consumer spending and government outlays remain elevated, gross private domestic investment continues to slip, this time by 1.5 percent on an annualized basis in the third quarter. While this is less than the 6.3 percent decline registered during the second quarter, the key takeaway is that the current economic expansion is narrowing, increasingly fueled by consumers and public agencies taking on additional debt.”

Second, some segments of nonresidential construction continued to soften, Basu said. “Recent data regarding nonresidential construction spending indicate weaker spending in categories such as office and lodging. This was reflected in [the] GDP report, which indicated that spending on structures contracted significantly during the third quarter. For the most part, nonresidential construction spending growth continues to be driven by public construction, including in categories such as water supply and public safety.”

Basu said the primary question is whether the slowdown in economic activity will persist into 2020. “Many factors suggest it will, including a weakening global economy, a U.S. manufacturing sector that is arguably already in recession, vulnerability attributable to massive accumulations of public, corporate and household debt and the uncertain outcomes attached to ongoing trade negotiations. On the other hand, U.S. equity markets have continued to surge higher in the context of better-than-expected corporate earnings and ongoing accommodation by the Federal Reserve. Put it all together and the outlook for the U.S. economy has seldom been more uncertain, especially given next year’s elections.”