Construction backlog increases in August, ABC reports

- November 18, 2020

- Posted by: Alan Hageman

- Category: News

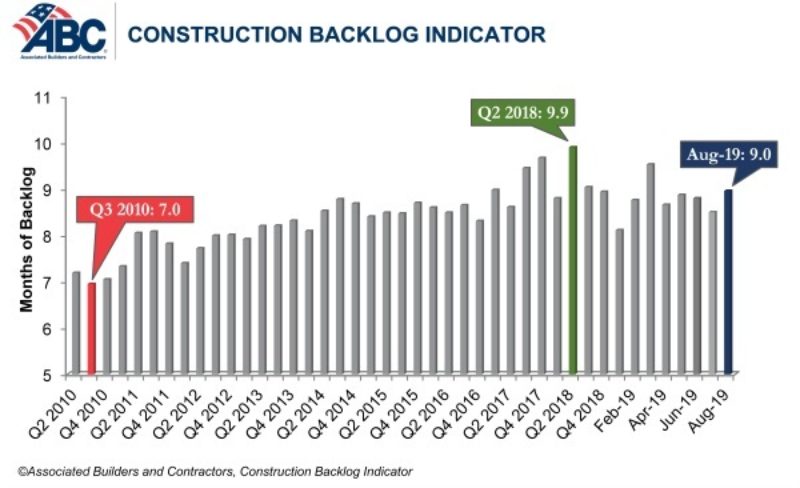

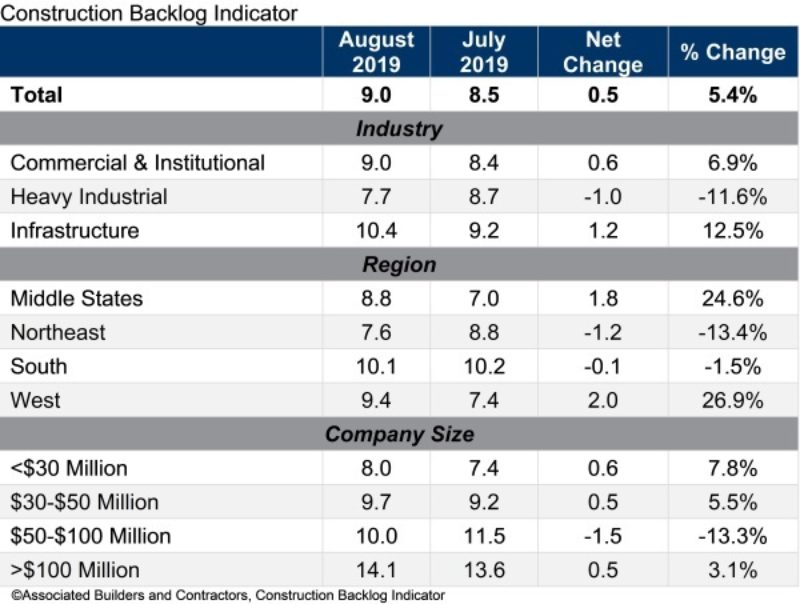

Associated Builders and Contractors (ABC) reported its Construction Backlog Indicator (CBI) climbed to nine months in August, up 0.5 month, or 5.4 percent, from July, when CBI stood at 8.5 months.

“Despite some other leading indicators suggesting weakening in nonresidential construction spending, our most recent backlog readings show that contractors are still experiencing significant demand for construction services” said ABC chief economist Anirban Basu. “The primary issue for most contractors is not a lack of demand, but an ongoing and worsening shortage of skilled workers available to meet contractual requirements.”

Basu said though the report was generally positive, softening activity in the U.S. manufacturing sector is becoming more apparent in construction data. “Specifically, backlog in the heavy industrial category slipped to 7.7 months in August, a decline of 12 percent. A number of key manufacturing indicators have been weakening of late, including capacity utilization and the Institute for Supply Management’s index for manufacturing. It appears that the slowdown in factory activity is now being reflected in construction spending data.”

By contrast, backlog for those involved in heavy highway projects or other forms of infrastructure was 10.4 months, an increase of about 13 percent, Basu said. “The implication is that state and local governments are leveraging stronger fiscal positions and lower borrowing costs to move forward with more infrastructure projects,” he said. “Not only is this a source of strength for the U.S. economy, it is helping to support overall nonresidential construction spending. Growing contractual volume in the infrastructure category helped to push backlog among middle states contractors up to 8.8 months, a 1.8-month gain. Overall, backlog continues to be lengthiest in the South and West.”