Engineering and Construction Cost Pressures Remain Even As Economic Uncertainty Grows

- November 28, 2020

- Posted by: Alan Hageman

- Category: News

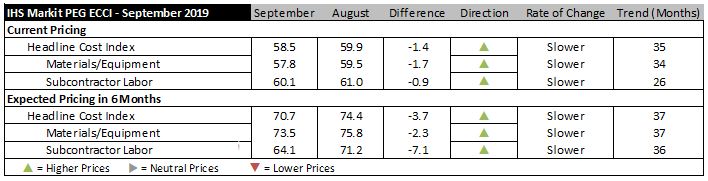

U.S. construction costs increased once again in September, according to IHS Markit and the Procurement Executives Group (PEG). The current headline IHS Markit PEG Engineering and Construction Cost Index registered 58.5 in September, a slight dip from August’s reading of 59.9, recording the 35th consecutive month of construction cost increases. Both the materials and equipment and sub-contractor labor indexes indicated continued price increases, with readings of 57.8 and 60.1, respectively.

Survey respondents reported increasing prices for 10 out of the 12 components within the materials and equipment sub-index. Within materials, the diffusion index for ready-mix concrete and alloy steel pipe increased relative to last month. Equipment categories such as transformers, turbines, pumps and exchangers also posted increasing prices, with index figure coming in higher compared to last month. Carbon steel pipe prices declined and copper prices stayed flat.

“Sentiment in the copper market has been decidedly pessimistic, as can be seen in the large short positions being maintained on the CME and LME by money managers,” said John Mothersole, director of research at IHS Markit. “However, we still believe that copper prices will rise over the near term because even with a relatively weak consumption growth forecast, market balance calculations continue to show a market deficit for 2019 and into 2020. It is this sluggish supply-side expansion that keeps the market tight and points to higher prices.”

The sub-index for current subcontractor labor costs reported rising labor costs in all regions of the United States and in both Eastern and Western Canada.

The six-month headline expectations for future construction costs index reflected increasing prices for the 37th consecutive month, with the index registering 70.7, a slight dip from August’s 74.4. The six-month materials and equipment expectations index came in at 73.5 this month, down from 75.8 last month. All materials registered increasing prices. Expectations for sub-contractor labor ticked down to 64.1 in September with labor costs expected to rise in all regions of the U.S. and Western Canada.

In the survey comments, respondents noted shortages for some skilled labor.

To learn more about the IHS Markit PEG Engineering and Construction Cost Index or to obtain the latest published insight, please click here.